This month’s briefing paper brings Saudi Arabian production and oil speculation into the spotlight. Click opbp_june_2008 for the PDF version.

Oil prices continue to maintain their record high levels, and consequently the New Zealand economy is likely to move into a recession, accompanied by high inflation. In particular, the petro-chemical, airline and fishing industries are coming under increased pressure as a direct result of increasing oil prices.

An international summit between oil consuming and producing nations was hosted in Jeddah, Saudi Arabia on the weekend of the 21st June. Oil consuming nations sought to convince Saudi Arabia to increase its oil supply. No offers were forthcoming from oil consuming nations to reduce their demand. The summit produced no practical outcomes as the proposed increase in output from Saudi Arabia had already been signalled previously. We examine the Saudi Arabian oil supply situation in detail in this month’s edition of the Oil Production Briefing Paper. We also examine claims that speculators are adding a premium to the price of oil.

The Campaign for Better Transport went public last week with a call for the development of a central Government contingency plan in the event that oil prices proceed to climb through the $US150 a barrel mark. Reaction from the Government was that the status quo of heavy investment in increasing the capacity of fossil fuel based transport infrastructure would continue, an example of this being confirmation that the $1bn Transmission Gully motorway project would proceed to the next stage. However, Government commitment to the buyback of Toll’s rail operations and expenditure on Auckland’s rail network was highlighted in Question Time in Parliament last week.

Fishing industry representatives in New Zealand last week warned that high diesel costs were “crippling the industry”. Westfleet Fisheries principal Craig Boote said that fuel costs now constituted 80% of his business costs, and that “we had no idea this was going to happen – who could have predicted it? We can’t possibly put the price of fish up enough to compensate.”

Spotlight: Saudi Arabia Oil Production

Following the recent summit in Jeddah, Saudi Arabia announced its crude oil production would increase to 9.7m barrels a day from July 2008, an increase of 200,000 barrels.

It isn’t clear what grades of oil will make up the supply increase or even if Saudi Arabia is capable of achieving this increase. In any case this increase won’t even offset Saudi Arabia’s own internal consumption increase in the last three years. Saudi Arabia’s growing economy has meant that oil demand grew from 2m barrels a day in 2005 to an estimated 2.3m barrels a day in 2007.

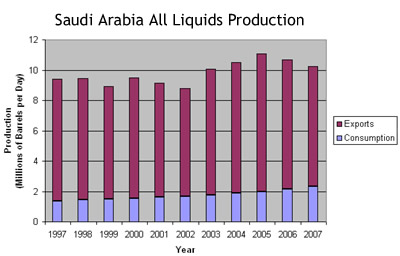

The following chart is derived from data from the US Energy Information Administration:

Saudi Arabian production data, across all grades, for the 2005 – 2007 period shows net exports declined by over a million barrels a day:

| Year | Production | Consumption | Net Exports |

|---|---|---|---|

| 2005 |

11,096 |

2,000 |

9,096 |

| 2006 |

10,665 |

2,139 |

8,525 |

| 2007 |

10,236 |

2,311 |

7,925 |

An analysis of the global net export situation is contained in the Net Export Trends section of this report.

Spotlight: The Role of Speculators in the Oil Market

“The first myth is that high prices are caused by technical factors, such as speculation. While these factors may have an impact on the margins, the data clearly show that high prices are really caused by economic fundamentals.”

– Tony Hayward (CEO BP), Financial Times (11/06/08)

Speculators are singled out by many commentators as a reason for the sudden surge in oil prices. However, there appears to be a lack an understanding of how “paper†commodity markets such as the NYMEX and ICE exchanges work.

Trading takes place on the futures market when two participants bet on the price of oil at a future date in time, in the same way that one might bet on the outcome of a rugby match, for example. The placing of a bet in the oil futures market does not affect the future price that a physical barrel of oil changes hands between a “real†supplier and a consumer.

Oil futures market participants do not take delivery of oil, which would be necessary to affect the price. Instead one speculator wins the bet while the other speculator loses the bet. Hence when the price of oil spikes, there are as many losers in the oil futures market as there are winners.

Furthermore, a number of businesses use the oil futures market as insurance from oil price increases. Air New Zealand, for instance, has covered 83% of its current quarter consumption to a maximum of $83 a barrel, at a time when the spot price of Singapore jet fuel is about twice this amount. If it weren’t for the presence of the oil commodity market, Air New Zealand would be under financial distress and / or airfares would be a lot more expensive than they are now.

Also note that it is only recently that the futures market has formed the view that prices will be flat or rising for the foreseeable future. Three years ago, the futures market was predicting long term prices of $45 a barrel, at a time that the spot price of oil was $60 a barrel. Since then, oil prices have continued to rise upwards in spite of speculators betting the price would come down, so the theory that speculators have been affecting the market is not supported by recent history.

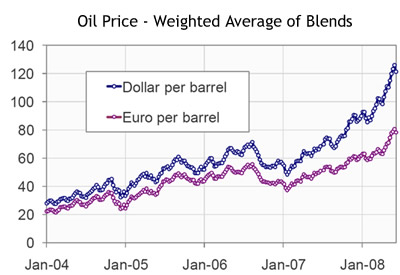

Oil Price Trends

Weighted Average

Denominated in either US dollars or Euros, the price of oil continues its upward trend of the last five years.

Aviation Fuel

Aviation fuel prices (Singapore Jet Fuel) have pulled back slightly from all time highs of almost $US175 a barrel in June, to currently sit around the $US160 a barrel mark.

Airlines that failed to hedge against record prices are the most vulnerable right now. British Airways is a good example, and has had to introduce increases of up to 26 per cent in fuel surcharges for its highest paying passengers, its second rise for premium flyers in just over a fortnight. Business class and first-class passengers on longer flights will pay a surcharge of up to £266 for a return ticket — up from £218. Passengers on shorter flights will pay £196, an increase from £155.

In the upcoming July quarter, Air New Zealand’s fuel hedge position moves to 65% coverage of fuel consumption to a ceiling of $US91 a barrel.

Oil Production Trends

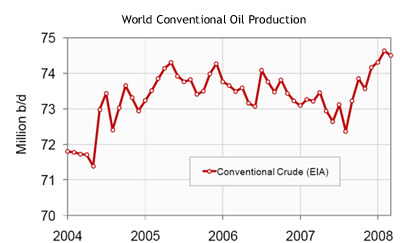

Conventional Oil

Latest figures from the EIA show that crude oil production decreased by 134,000 bpd from February to March.

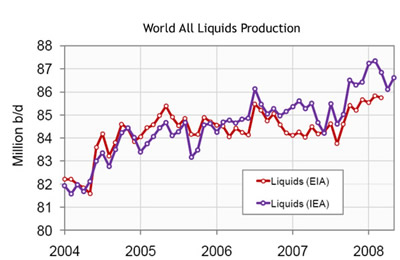

All Liquids

All liquids includes oil shale, biofuel, natural gas liquids as well as conventional oil.

Net Export Trends

The following table, showing oil production from all sources in thousands of barrels a day, demonstrates that output from net oil exporting countries is declining.

(source The Oil Drum )